Industry NewsDecember 12, 2020

Industrial connectivity – an overview

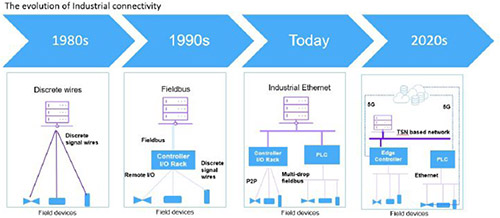

Connectivity is one of the fundamental pillars upon which the industrial IoT (IIoT) is built. And over the last few decades, industrial connectivity in particular has evolved considerably, especially in response to the ever-changing requirements of the manufacturing industry.

Following the advent of discrete wires to communicate with field devices, the Fieldbus industrial networking technology came into play, introducing the concept of a controller to communicate with field devices. A rival technology, Ethernet, became a household name in the early 1990s and then found gradual adoption by industry starting in the early 2000s.

Syed Mohsin Ali, Senior Analyst, Industrial Connectivity, Omdia

In many industrial networks today, Ethernet is deployed along with Fieldbus and wireless technologies. Those mechanisms continue to evolve even with the arrival in the industrial manufacturing world of much newer technologies, such as 5G, Time-Sensitive Networking (TSN), and Advanced Physical Layer (APL). The new technologies form part of a comprehensive examination of the industrial connectivity landscape covered by my recently published study, Industrial Communications Report – 2020.

A number game

The number of connected nodes being shipped every year continues to increase with an exception of 2020, Omdia estimates. Not only are more devices able to connect to a network, the number of nodes is also on the rise. The market for connected nodes in industrial communications approached 142 million units in 2019 and is forecast to grow to more than 204 million in 2024. The shift to Ethernet has accelerated as Industry 4.0 and IIoT solutions are maturing and becoming more prevalent, with Ethernet seen as the industrial networking technology enabling the solutions. Overall, the number of Ethernet-connected nodes will more than double from 67 million units to 117 million by 2024, translating into a compound annual growth rate (CAGR) of 11.3% for the Ethernet market during the five-year period, Omdia is forecasting.

PROFINET and EtherNet/IP, two industrial Ethernet protocols, account at present for 56.4% of newly connected Ethernet nodes, and both protocols will increase their share of market during the forecast period. By 2024, the two will represent more than 61.4% of all newly connected Ethernet nodes.

For Fieldbus, growth will decline for the same period with a 0.1% CAGR; Fieldbus-connected nodes are forecast to decline from 51.3 million to 50.9 million. Even so, Ethernet technologies have outpaced Fieldbus technologies on new connected nodes in 2019.

Evolution Of Connectivity

PROFIBUS remains the leading Fieldbus protocol at 20.7% market share of the Fieldbus market, but IO-Link is the fastest-growing, with many sensors using IO-Link for Fieldbus. Wireless use in industrial networks, meanwhile, will grow at a healthy CAGR of 12.1% during the same 2018-23 period, from 1.7 million connected nodes to 3 million. The two leading wireless protocols are WLAN and WirelessHART. Together with cellular, these three accounts for 63.5% of total market of the wireless protocol market.

Syed Mohsin Ali, Senior Analyst, Industrial Connectivity, Omdia